A professional limited liability company (PLLC) is a type of business entity that can be formed by individuals or business partners who perform a professional service.

Texas PLLCs differ from Texas LLCs in that PLLCs are formed specifically for individuals providing professional licensed services.

Forming a PLLC might be the right option for you if you are a licensed professional in Texas planning to open your own practice. State licensed professionals include accountants, architects, attorneys, and medical specialists, among others.

If you need assistance, or have questions about forming a PLLC, don’t hesitate to contact attorney Adam Curley of The Curley Law Firm today.

What Is a Texas PLLC

A professional limited liability company or PLLC is a specialized type of limited liability company (LLC).

Although similar to an LLC, a PLLC can only be formed by a limited number of licensed professionals performing those specific professional services. Under Texas law (Texas Business Organizations Code § 301.001), PLLC ownership and management must adhere to certain restrictions and requirements. A PLLC is an excellent option for licensed professionals not permitted to form an LLC under Texas law.

Some specific examples of professionals eligible to create a PLLC in Texas include:

- Attorneys;

- Accountants;

- Architects;

- Doctors and physicians;

- Other medical specialists;

- Mental health professionals;

- Dentists; and

, - Veterinarians.

Under statutory regulations, Texas PLLC ownership and management is limited to members who are professionally licensed to provide the professional services offered by the PLLC. For example, a receptionist at a doctor’s office could not be a member of the PLLC because receptionists are not professionally licensed by the state of Texas to practice medicine.

Contact Us

How Do I Form a PLLC

When forming a new business entity, you must comply with all applicable regulations and requirements. In order to form a professional LLC or PLLC in Texas, you and your business partners must satisfy three basic criteria:

- Ensure that every professional who is a member of your PLLC possesses a valid and appropriate state license for the profession;

- Obtain express authorization from the Texas state licensing board as required by your profession; and

- File the PLLC’s certification of formation with the Texas Secretary of State (SOS) and pay any associated fees.

Additionally, you will want to create an operating agreement for the PLLC. An operating agreement provides internal procedures for your PLLC. If your PLLC has multiple members, an operating agreement details member and manager responsibilities within the PLLC. The operating agreement should include the following information:

- The purpose of the PLLC;

- Capital contributions of members;

- Profit/loss distribution;

- Meeting and voting procedures; and

- Whether members or managers manage the PLLC.

Beyond these requirements, take proactive steps to put your company in the best position to succeed.

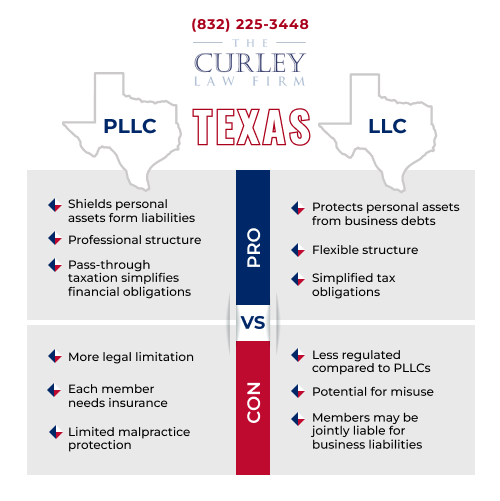

PLLC vs LLC in Texas: The Pros and Cons

Texas PLLCs and LLCs share similarities, but PLLCs face additional legal restrictions, particularly requiring state licensure for members. While PLLCs offer limited liability, they require licensed professionals and individual malpractice coverage. Both entities pass tax obligations to members. Consider structural and legal nuances when choosing.

In many ways Texas PLLCs are similar to LLCs. However, PLLCs are subject to additional legal restrictions and regulations. You may ask yourself: What are the benefits of a PLLC contrasted with an LLC?

At first glance, the PLLC structure is similar to, but more restricted than, an LLC. These restrictions pertain to the requirement that PLLC members be state licensed professionals. Therefore, it would appear that there are more advantages to an LLC.

However, for many types of professionals, it is not always possible to set up an LLC. There are different structural and legal reasons that make a Texas PLLC the best option for licensed professionals.

Like LLCs, each member of the PLLC enjoys limited liability within the company. Additionally, PLLC members are not liable for the negligence of any other member of the PLLC. Texas PLLCs do not provide blanket liability protection against a malpractice claim. Instead, each professional member of the PLLC must obtain their malpractice coverage—either individually, or through the company.

PLLCs pay taxes in the same manner as LLCs. The PLLC itself does not pay taxes. The net income and losses of the PLLC passes to each member. Each member then claims their share of the net income and losses as part of their tax return.

Let Us Help You Form Your Texas PLLC the Right Way!

If you are a licensed professional preparing to form a new company, take the proper steps to protect your rights, interests, and career. With the right business structure in place, your professional practice will be in a position to thrive.

The Curley Law Firm focuses on building lasting relationship with all clients by undertaking the following:

- Take the time to understand your situation, needs, and objectives;

- Prepare and submit the documents required to form a PLLC in Texas;

- Negotiate, draft, and review a PLLC operating agreement; and

- Take whatever action is necessary to protect your personal and business interests.

When it comes to business entities, Attorney Adam J. Curley has over a decade of experience counseling business owners and business partners to choose the most advantageous path toward a successful enterprise.

We commit to helping you plan and build a successful future. If you have any questions about PLLCs in Texas, we are here to help. Our practice prides itself on building positive, effective, and long-term relationships with our clients. We know that all businesses and business owners have unique needs. If you are forming a professional limited liability company (PLLC) in Texas, you deserve diligent, fully personalized legal guidance. For a confidential initial business law consultation, please contact us today.